Want a Verified Apple Pay Account but worried about the headlines you’ve seen about buying accounts online? Smart move to be cautious. Buying verified accounts might look like a shortcut, but it’s a huge risk — for your money, your identity, and your freedom to use digital payments. This guide shows you how to legitimately verify Apple Pay, fix common problems, use Apple‑like payment features on Android, and keep your financial life secure.

Why you should never buy a verified Apple Pay Account

Imagine someone selling you a car without registration papers. Looks tempting — until the police stop you. Buying verified Apple Pay accounts is similar:

- Violates bank and Apple terms. Most banks and Apple’s agreements prohibit account transfer or resale. Using a bought account can lead to suspension, frozen funds, or legal trouble.

- Often stolen or fraudulent. Many sold accounts are created with stolen identities or hacked cards. You could become an accessory to fraud without meaning to.

- No support or guarantees. If the account is revoked, you have no official recourse — the bank and Apple won’t help.

- Security nightmare. Sellers often include reused credentials, making you vulnerable to phishing, SIM swaps, or malware.

Would you risk your finances for a “cheap” shortcut? Don’t. Instead, the following steps give you a verified Apple Pay account the right way.

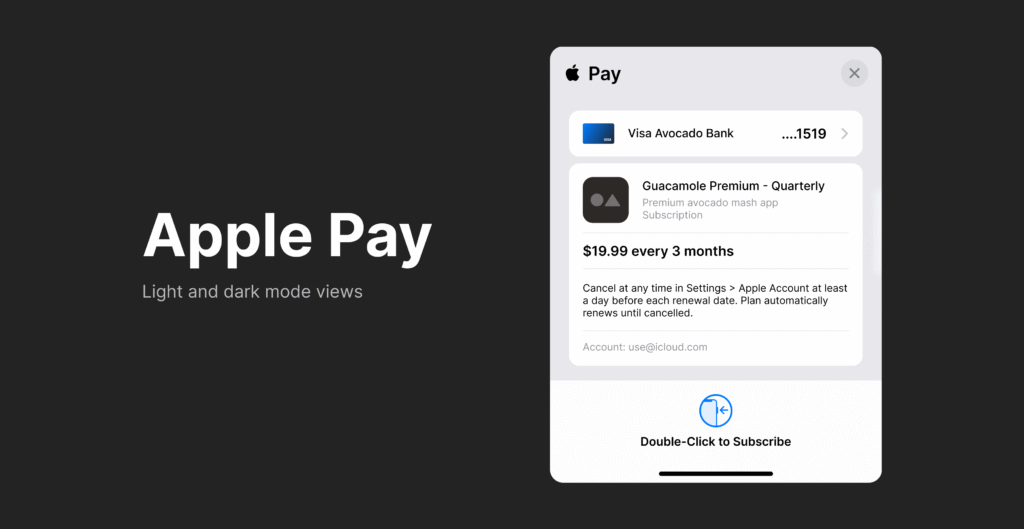

What “verified” actually means for Apple Pay

A Verified Apple Pay Account usually means:

- Your Apple ID is authenticated and protected (2FA enabled).

- You’ve added a supported bank card to Apple Wallet.

- The issuing bank has verified that card via SMS, app confirmation, or another secure method.

Once verified, you’ll see receipts in Wallet, be able to tap at stores (Target, Home Depot, Kroger, Lowes, Walmart and more where contactless is accepted), and use Apple Pay for in‑app and web purchases.

Step‑by‑step: Legally verify your Apple Pay account

Follow these steps — think of this like assembling a secure, digital wallet.

- Check device compatibility

- Apple Pay works on iPhone, iPad, Apple Watch, and Mac models that support Wallet. Update to the latest iOS or macOS.

- Secure your Apple ID

- Sign in at appleid.apple.com. Turn on Two‑Factor Authentication (2FA). Use a strong, unique password.

- Open Wallet and add a card

- Wallet → tap “+” → add credit, debit, or supported prepaid card. Many banks (Capital One, local banks) support Apple Pay — check their website or app if unsure.

- Complete the bank’s verification

- Your bank may send an SMS code, ask you to confirm through its app, or make a temporary charge. Finish this step — it’s what verifies the card.

- Set a default card & test

- Choose your default card in Wallet. Make a small test purchase or use the “Apple Pay” option in an app to confirm everything’s working.

- Keep everything backed up and secure

- Use a password manager for credentials, keep 2FA on, and never share verification codes.

Apple Pay on Android — what you need to know

You asked about “apple pay and android” and “apple pay for android.” Officially, Apple Pay is not available for Android devices. But you have alternatives:

- Google Wallet: The Android equivalent for contactless payments at many retailers.

- Samsung Wallet / Samsung Pay: For Samsung phones, a robust option accepted widely.

- Bank apps: Some banks offer proprietary tap‑to‑pay inside their Android apps.

- Payment acceptance: Most merchants that accept contactless (like Home Depot, Kroger, Target, Lowes, Walmart) will accept Google Wallet or Samsung Pay on Android.

If you’re switching devices or sharing payment methods across platforms, use bank tokens or multi‑platform cards rather than trying to run Apple Pay on non‑Apple hardware.

Troubleshooting & common questions

- Card won’t verify: Confirm the card is supported for Apple Pay. Update your bank app and make sure your billing address matches.

- Apple Pay not showing at checkout: Ensure the merchant accepts contactless payments. For web purchases on Mac, confirm your Mac model supports Apple Pay and that you’re signed in with the same Apple ID.

- Missing receipts: Apple Wallet stores recent Apple Pay receipts. If something’s missing, check the merchant’s email receipt or the bank statement.

Security checklist (quick wins)

- Enable 2FA on your Apple ID.

- Use a unique password stored in a password manager.

- Don’t share verification codes or passwords.

- Check bank statements weekly for unexpected activity.

- If a device is lost, use Find My to lock or erase it remotely.

- Keep your bank’s fraud department number handy.

If someone offers you a verified account

Refuse. Report the seller to the marketplace. If you already bought an account, stop using it, contact your bank, and consider reporting to local law enforcement — you may have been scammed.

FAQ

Can I use Apple Pay at Walmart or Home Depot?

Many Walmart stores accept contactless payments via Google Wallet and other wallets, while Apple Pay acceptance varies by country and location. Home Depot and many big retailers accept contactless payments — always check the terminal or store signage.

Are prepaid cards supported in Apple Pay?

Some prepaid cards work with Apple Pay; it depends on the issuer. Prepaid cards may require additional verification via the bank or card issuer.

How do I view Apple Pay receipts?

Receipts from Apple Pay purchases appear in the Wallet app or the merchant’s email / app. Also review your bank statements for transaction details.

Final thoughts — convenience with responsibility

A verified Apple Pay account makes everyday purchases faster and often more secure — but convenience shouldn’t cost your security or legal standing. protect your identity, and keep your money safe.