In 2025, running a business without international payment support is like opening a store without a checkout counter. Customers today expect fast, secure, and flexible payment options—no matter where they live. Whether you run an online store, SaaS company, agency, or digital service, choosing the right business payment gateway is essential for growth.

A powerful payment gateway for business does more than just process payments. It builds trust, reduces cart abandonment, protects against fraud, and ensures smooth cash flow across borders. For small businesses, the right gateway can mean the difference between struggling locally and scaling globally.

In this in-depth guide, we’ll explore the top international payment gateways for global businesses, explain how they work, and help you choose the best payment gateway for business based on your goals.

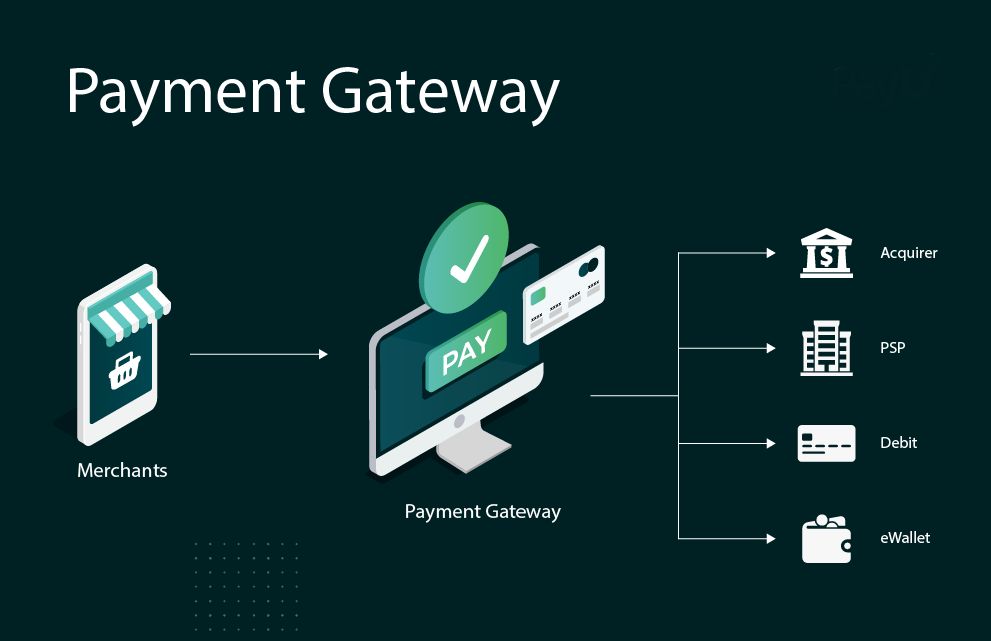

What Is a Business Payment Gateway?

A business payment gateway is a technology that allows businesses to accept online payments from customers securely. It acts as a bridge between the customer’s payment method (card, wallet, crypto) and the business’s bank account.

A modern payment gateway business solution typically includes:

- Secure card and wallet payment processing

- Multi-currency and cross-border support

- Fraud detection and encryption

- Fast payouts and settlement options

- Integration with websites, apps, and eCommerce platforms

For global companies, choosing the best payment gateway for online business is critical to avoid failed payments, high fees, and customer frustration.

Why Global Businesses Need business payment gateway

Selling internationally introduces challenges that local gateways can’t handle.

An international payment gateway for business helps by:

- Accepting payments from multiple countries

- Supporting local currencies and cards

- Reducing cross-border transaction failures

- Improving checkout success rates

- Minimizing currency conversion losses

For startups and SMEs, this makes an international payment gateway for small business a growth enabler, not just a tool.

1. Stripe – Best Overall Payment Gateway for Global Businesses

Stripe is one of the most advanced and flexible business payment gateway solutions available today.

Why Stripe Is Ideal for International Growth

Stripe supports payments in over 135 currencies and is trusted by businesses ranging from startups to global enterprises. It’s highly customizable and works well for websites, mobile apps, SaaS platforms, and marketplaces.

Key Advantages:

- Accepts international cards and local payment methods

- Powerful fraud prevention with machine learning

- Recurring billing and subscription support

- Seamless API and plugin integrations

- Fast payouts in many regions

Stripe is widely considered the best payment gateway for business planning long-term global expansion.

2. PayPal – Most Trusted Online Payment Gateway for Small Business

PayPal remains one of the most recognized payment gateway for business solutions worldwide.

Why PayPal Builds Instant Trust

Customers trust PayPal because of its strong buyer protection and brand reputation. This trust often leads to higher conversion rates, especially for new or lesser-known businesses.

Key Benefits:

- Available in 200+ countries

- Supports multiple currencies

- Easy checkout experience

- Buyer and seller protection

- Simple integration

PayPal is an excellent online payment gateway for small business that wants quick international reach without technical complexity.

3. Airwallex – Best for Multi-Currency Business Payments

Airwallex is a modern business payment gateway designed specifically for global operations.

Why Airwallex Is Different

Airwallex allows businesses to hold, receive, and send multiple currencies using local accounts, significantly reducing foreign exchange costs.

Key Features:

- Local currency accounts in major markets

- Low FX and cross-border fees

- Global payouts to suppliers and partners

- Strong compliance and security

Airwallex is ideal for companies managing international suppliers, remote teams, or global customers.

4. Square – Best Payment Gateway for Small Business with Physical Stores

Square is a strong payment gateway for small business that operates both online and offline.

Why Square Works Well

Square allows businesses to manage online payments, in-store POS, inventory, and reporting from one system.

Benefits:

- Unified online and offline payments

- Transparent pricing

- Fast setup with minimal paperwork

- Real-time sales analytics

Square is especially useful for retail businesses expanding into eCommerce.

5. Wise Business – Best Low-Cost International Payment Gateway

Wise Business is not a traditional gateway but is widely used alongside gateways as a cost-saving business payment gateway solution.

Why Wise Business Is Valuable

Wise uses real exchange rates and charges very low fees, making it ideal for international transfers.

Advantages:

- Mid-market exchange rates

- Multi-currency accounts

- Fast international transfers

- Transparent pricing

Wise is often combined with Stripe or PayPal to reduce international payout costs.

6. Adyen – Best Enterprise-Level Payment Gateway Business Solution

Adyen is a premium payment gateway business platform used by global brands like Uber, Spotify, and Microsoft.

Why Enterprises Choose Adyen

Adyen offers a single global payment system that supports local payment methods worldwide.

Key Strengths:

- High approval rates

- Advanced risk management

- Global payment optimization

- Enterprise-grade scalability

Adyen is best for large, high-volume international businesses.

7. Crypto Payment Gateway for Business – Borderless & Future-Ready

A crypto payment gateway for business allows companies to accept digital currencies like Bitcoin, Ethereum, and stablecoins.

Why Businesses Are Adopting Crypto

Crypto payments remove borders and reduce reliance on traditional banking systems.

Key Benefits:

- No currency restrictions

- Faster settlement times

- Lower transaction fees (in many cases)

- Reduced chargebacks

For global digital businesses, crypto gateways offer a future-ready alternative.

Best Payment Gateway for Small Business: What to Look For

When choosing the best payment gateway for small business, focus on:

- Easy setup and integration

- Transparent pricing

- Multi-currency support

- Strong security features

- Scalability

Stripe, PayPal, Square, and Wise are top contenders for small businesses worldwide.

Best Online Payment Gateway for Small Business UK

UK businesses need gateways that support GBP, UK cards, and international payments.

Top options include:

- Stripe UK

- PayPal UK

- Square UK

- Adyen (for larger firms)

These are commonly recommended as the best online payment gateway for small business UK.

Security, Compliance & Fraud Protection

Security is non-negotiable when choosing a payment gateway for business.

Look for gateways that offer:

- PCI-DSS compliance

- Data encryption and tokenization

- AI-powered fraud detection

- Chargeback management tools

Strong security protects both your business and your customers.

Final Thoughts

A reliable business payment gateway is the backbone of any successful global business. From accepting international cards to managing currencies, reducing fraud, and improving checkout experience—the right gateway fuels growth.

Whether you’re a startup, SME, or enterprise, choosing the best payment gateway for business ensures smoother operations, happier customers, and stronger global reach.

Invest wisely, because the right payment gateway business solution doesn’t just process payments—it powers global success.

Frequently Asked Questions (FAQs)

What is a business payment gateway?

A business payment gateway is a secure technology that allows businesses to accept online payments from customers. It processes card, wallet, bank, or crypto transactions and transfers the funds safely to the business account.

Which is the best payment gateway for business?

The best payment gateway for business depends on your size and goals. Stripe is ideal for global scalability, PayPal is trusted worldwide, Airwallex is great for multi-currency operations, and Square works well for small businesses with physical and online stores.

What is the best payment gateway for small business?

For startups and SMEs, the best payment gateway for small business usually offers easy setup, transparent fees, and global support. Stripe, PayPal, Square, and Wise are popular choices for small businesses.

Is there a difference between a payment gateway for business and small business?

A payment gateway for business is designed to handle larger volumes, advanced features, and scalability, while a payment gateway for small business focuses on simplicity, affordability, and quick setup. Many modern gateways support both.

What is the best online payment gateway for small business UK?

The best online payment gateway for small business UK includes Stripe UK, PayPal UK, Square UK, and Adyen (for larger companies). These gateways support GBP, UK cards, and international payments.

Can a business use more than one payment gateway?

Yes, many global companies use multiple gateways. Using more than one payment gateway business solution improves payment success rates, reduces downtime risk, and gives customers more payment options.

What fees should I expect from a business payment gateway?

A business payment gateway may charge transaction fees, currency conversion fees, cross-border fees, and sometimes chargeback fees. Always review the full pricing structure before choosing the best payment gateway for business.

Are crypto payment gateways safe for businesses

Yes, a crypto payment gateway for business is safe when it uses secure wallets, encryption, and compliance checks. Many businesses accept stablecoins to avoid price volatility while enjoying fast, borderless payments.

How secure are online payment gateways?

Modern payment gateway for business solutions use PCI-DSS compliance, encryption, tokenization, and AI-based fraud detection. These measures ensure secure transactions and protect customer data.

How do I choose the right payment gateway for my online business?

To choose the best payment gateway for online business, consider fees, supported countries, currencies, integration options, security features, and scalability. The right gateway should match both your current needs and future growth plans.