Running a successful dropshipping or eCommerce business is not just about finding trending products or mastering marketing — it’s also about making it easy and secure for customers to pay. A reliable dropshipping payment system ensures smooth transactions, builds trust, and helps boost your store’s conversion rate.

Choosing the right dropshipping payment gateway is essential for both new entrepreneurs and seasoned store owners. The right system can help you expand globally, reduce cart abandonment, and streamline your operations.

In this article, we’ll break down the 17 best payment gateways for dropshipping and eCommerce stores, including their key features, fees, benefits, and who they are best for.

What Is a Dropshipping Payment Gateway?

A payment gateway dropshipping service is the technology that connects your online store to your customer’s bank or card provider. It securely collects payment information, encrypts it, and sends it to the payment processor for approval.

Think of it as a digital cashier for your online store — it handles the sensitive financial details so your customers don’t have to worry, while keeping your business protected against fraud.

A dropshipping payment processor is closely related — it’s the system that moves the money from the customer’s account to your merchant account after the payment is approved. Both work together to make online shopping seamless, fast, and secure.

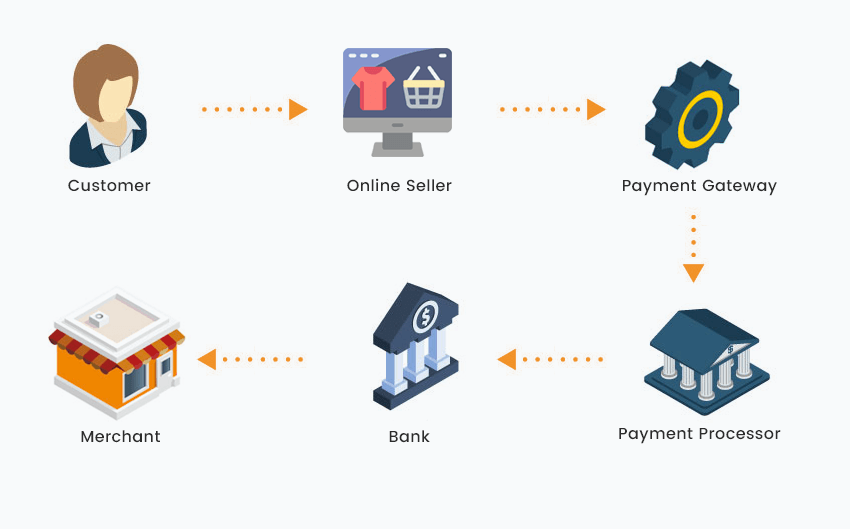

How Dropshipping Payment Processing Works

Understanding how dropshipping payment processing works will help you choose the right system for your store. Here’s the step-by-step flow:

- Customer Checkout: The customer enters their payment details at checkout.

- Secure Transfer: The payment processor for dropshipping encrypts and sends the information to the customer’s bank or card issuer.

- Approval or Decline: The bank verifies the payment and either approves or declines it.

- Funds Transfer: Once approved, the funds are deposited into your merchant account.

A reliable dropshipping payment method ensures transactions happen instantly or within a few hours, avoiding delays or lost sales. Slow or error-prone gateways can frustrate customers and increase abandoned carts.

Why the Right Dropshipping Payment Method Is Crucial

Choosing the best payment method for dropshipping has a direct impact on your business growth. Here’s why:

1. Boosts Sales and Conversions

Customers are more likely to complete a purchase when they see familiar and trusted payment options. Offering multiple payment methods for dropshipping like credit cards, PayPal, or digital wallets can dramatically improve conversion rates.

2. Reduces Fraud and Chargebacks

High-quality gateways provide advanced fraud detection and security measures. This protects both your business and your customers from fraudulent transactions, saving you money and headaches.

3. Supports Global Sales

If your store targets international customers, a dropshipping payment gateway that supports multiple currencies, local payment methods, and international banks is essential. It allows you to expand globally without worrying about payment issues.

4. Streamlines Accounting and Reporting

Many payment processors offer dashboards with detailed transaction histories, customer insights, and analytics. This simplifies bookkeeping and helps you make informed business decisions.

5. Improves Customer Experience

A smooth, hassle-free checkout process keeps customers happy and encourages repeat purchases. Slow, confusing, or insecure payment options can drive customers away.

17 Best Payment Gateways for Dropshipping & eCommerce

Here are the top dropship payment gateway options for your store, along with detailed insights:

1. PayPal

PayPal is one of the most trusted dropshipping payment processors worldwide. With over 400 million active users, customers feel secure using it. PayPal supports multiple currencies, credit cards, and PayPal balances, making it ideal for global sales.

Pros: Easy setup, strong trust signals, buyer and seller protection.

Cons: Higher transaction fees for international sales.

Best for: Beginners and stores looking to establish credibility quickly.

2. Stripe

Stripe is a developer-friendly gateway ideal for Shopify, WooCommerce, and custom stores. It offers advanced features like recurring payments, mobile wallets, subscription billing, and detailed analytics.

Pros: Highly customizable, supports multiple currencies, fast payouts.

Cons: Requires some technical knowledge for advanced features.

Best for: Scalable businesses and tech-savvy entrepreneurs.

3. Adyen

Adyen is a robust international payment solution trusted by brands like eBay and Uber. It supports over 250 payment methods and offers detailed fraud prevention tools.

Pros: Ideal for global transactions, advanced reporting, strong security.

Cons: May be complex for small businesses just starting out.

Best for: High-volume and international stores.

4. 2Checkout

2Checkout makes it easy to sell worldwide with support for multiple currencies and languages. Its seamless integration with major eCommerce platforms helps stores expand globally.

Pros: Easy international payments, simple integration, flexible pricing plans.

Cons: Slightly higher fees for international cards.

Best for: Stores looking for global expansion with minimal hassle.

5. Vapulus

Vapulus offers zero transaction fees and is highly mobile-friendly. This makes it perfect for cost-conscious entrepreneurs and stores targeting mobile users.

Pros: No transaction fees, mobile-focused, simple interface.

Cons: Limited brand recognition compared to PayPal or Stripe.

Best for: Startups and mobile-first stores.

6. PaySimple

PaySimple allows flexible payment acceptance, including credit cards, e-checks, and recurring billing. It also provides detailed reporting tools.

Pros: Recurring billing support, analytics, multiple payment types.

Cons: Less known internationally.

Best for: Businesses needing detailed reporting and recurring billing.

7. Dwolla

Dwolla specializes in U.S. bank transfers, offering fast and secure payments. It integrates easily with most financial institutions.

Pros: Direct bank payments, fast transfers, easy setup.

Cons: Limited international support.

Best for: U.S.-based stores and bank transfer payments.

8. Square

Square is known for POS systems but also supports online payments. It integrates with Shopify, WooCommerce, and other platforms.

Pros: Omnichannel support, easy setup, reliable.

Cons: Limited features outside the U.S.

Best for: Stores selling both online and offline.

9. Payoneer

Payoneer excels at international payouts, making it perfect for paying suppliers, freelancers, or contractors.

Pros: Supports multiple currencies, low-cost international transfers.

Cons: Not as customer-facing as PayPal.

Best for: Stores with global suppliers or remote teams.

10. CardinalCommerce

CardinalCommerce focuses on fraud prevention and secure transactions, reducing the risk of chargebacks.

Pros: Strong fraud protection, seamless checkout.

Cons: Not as widely known among casual shoppers.

Best for: High-risk or high-value stores.

11. Skrill

Skrill is ideal for low-cost international transactions and mobile payments. Its mobile app makes managing payments on the go simple.

Pros: Mobile-friendly, low fees, supports multiple currencies.

Cons: Not as widely recognized as PayPal.

Best for: Mobile-first and international stores.

12. Authorize.net

Authorize.net, a Visa-owned platform, is perfect for established online and in-person stores. It offers fraud protection, tokenization, and easy reporting.

Pros: Reliable, secure, well-established.

Cons: Setup can be complex for beginners.

Best for: Established merchants and high-volume stores.

13. WePay

WePay is backed by Chase, providing strong support and integrated banking solutions.

Pros: Reliable support, easy integration with banking, good fraud detection.

Cons: Limited international support.

Best for: Stores seeking secure banking integration.

14. BlueSnap

BlueSnap offers global payment support with dozens of currencies and languages. Its analytics help optimize your payment strategies.

Pros: Global reach, analytics tools, flexible integration.

Cons: Slightly higher fees for small transactions.

Best for: International stores with diverse customer bases.

15. Braintree

Braintree, part of PayPal, allows for customizable checkout experiences and supports over 130 currencies.

Pros: Scalable, branded checkout, supports mobile wallets.

Cons: Slightly more technical setup.

Best for: Stores seeking scalability and customization.

16. Amazon Payments

Amazon Payments lets customers pay using their Amazon account. Familiarity can increase trust and reduce cart abandonment.

Pros: Trusted brand, familiar checkout experience.

Cons: Limited to Amazon users.

Best for: Stores targeting Amazon-savvy shoppers.

17. Payline

Payline offers flexible pricing and contracts, making it ideal for high-volume or high-risk sales.

Pros: Scalable, flexible pricing, high-risk friendly.

Cons: Slightly complex pricing model.

Best for: Fast-growing or high-volume stores.

How to Choose the Right Dropshipping Payment Processor

When selecting a dropshipping payment gateway, consider:

Fees & Pricing

Look at both transaction fees and monthly costs. Some gateways are free to start but take higher percentages per sale, while others charge monthly fees but lower per-transaction costs.

Global Reach & Currency Support

If you sell internationally, pick a gateway that supports multiple currencies, countries, and local payment methods.

Integration with Your Store

Check that the gateway integrates with Shopify, WooCommerce, or your chosen eCommerce platform. A difficult integration can waste time and money.

Security & Fraud Protection

PCI compliance, fraud detection, and secure encryption are critical to protect both your business and customers.

Customer Experience

A smooth checkout flow reduces cart abandonment and boosts repeat purchases.

Conclusion

A reliable dropshipping payment processor is critical for any online store. From trusted names like PayPal and Stripe to global leaders like BlueSnap and Adyen, the options above cover every business need. Evaluate fees, features, international support, and security before selecting a gateway.

The right dropshipping payment method not only ensures your store runs smoothly but also increases conversions, protects your business, and helps you grow globally.

What is the difference between a payment gateway and a payment processor?

A payment gateway securely collects payment information, while a payment processor for dropshipping moves funds from the customer’s account to yours.

Can I use multiple dropshipping payment methods on my store?

Yes! Offering multiple payment methods for dropshipping increases customer satisfaction and sales.

Do all payment gateways work with Shopify?

Most major gateways like Stripe, PayPal, and Square integrate with Shopify, but always confirm before implementation.